Estimating the Size of a BEAD Rainy-Day Fund Focused on Bolstering Last Mile Connectivity Projects

by Paul Garnett and Greg Guice

Last month, we released a blog describing broad and growing bipartisan support for allowing state and territorial broadband offices (“Eligible Entities”) to use their remaining uncommitted Broadband Equity, Access, and Deployment (BEAD) funds (what we have termed the “Digital Opportunity Dividend”) for broadband projects that further the Infrastructure Investment and Jobs Act’s (IIJA) direction that Eligible Entities use allocated funds to “facilitate the goals of the BEAD program.” In that blog, we mentioned that one potential use for these remaining funds would be for the National Telecommunications and Information Administration (NTIA) to allow Eligible Entities to reserve a portion of their allocated but uncommitted BEAD funding for a “rainy-day fund” focused on bolstering BEAD-funded last mile connectivity projects and ensuring that high-speed last mile infrastructure is extended to unserved and underserved locations not identified for support in the first round of BEAD funding. In this blog, we look at how NTIA and Eligible Entities could size such a fund, taking into account not only locations that are currently not funded under BEAD, but also future growth in rural locations and inflation that could occur over the course of the next five years.

As we know from past deployment efforts, the cost of deploying networks will likely rise over the course of a deployment program, last mile infrastructure will need to be deployed to new locations, and some subgrantees will default on their commitments. BEAD has many differences from the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund (RDOF), but lessons learned from that multi-billion-dollar program provide a basis for how to size a rainy-day fund for BEAD.

RDOF was part of a series of efforts undertaken by the FCC beginning in 2020 to address the lack of timely broadband deployment in rural areas. Through RDOF, the FCC established a fund of up to $20.4 billion over 10 years to network operators that competed in a reverse-auction (lowest bidder wins) to deliver broadband to census blocks that were identified as lacking access to at least 25/3 Mbps broadband. After all the bids were in, $9.2 billion was awarded to auction winners committed to serving 5.1 million locations.

Since the close of the auction five years ago, 37% of those awards, more than 1.9 million locations representing nearly $3.3 billion in funding, have gone into default (meaning that RDOF winners have been unwilling or unable to fulfill their buildout commitments). And defaults under RDOF continue to rise.

Because most defaults occurred during the period in which Eligible Entities were identifying unserved and underserved locations eligible for funding under the BEAD program, most RODF defaults have already been addressed through the BEAD program. However, using FCC public data, we found that up to 37,000 locations across nine states will be left without access to high-speed broadband services because of RDOF defaults that occurred after Eligible Entities finalized locations for BEAD funding. In addition to the RDOF defaults that occurred prior to the BEAD program setting eligible locations, we project that an additional 16,000 RDOF locations could default by the end of 2028 using current trends. When combined, these represent up to 53,000 locations that are currently not funded through the BEAD program.

Beyond the unfunded RDOF locations, we know that there will be new homes built over the course of the BEAD program, and these homes will need to be connected as well. While new housing built in urban and suburban areas will likely be addressed by the market, homes in higher cost rural areas may not. To address this, we factored rural housing growth rates into our calculations. Using data from the Housing Assistance Council, we estimate that there will be approximately 125,000 rural new builds that need connectivity by the end of 2028. Thus, in total, we estimate that a rainy-day fund will likely need to provide funding for as many as 178,000 locations.

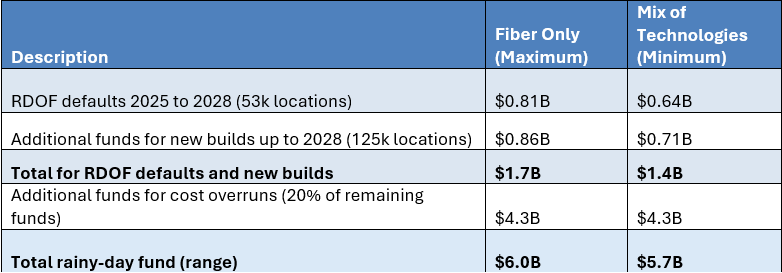

Accounting for the above factors, leveraging BEAD costs per location for fiber, fixed wireless, and satellite from submitted BEAD final proposals, and building in a 3% inflation rate, we estimate that it will require between $1.4 billion and $1.7 billion to reach these RDOF defaulted locations and new builds. That represents between roughly 6.5% to 8% of the approximately $21 billion of the remaining BEAD funds. These amounts and percentages will vary by state or territory, based on the location of RDOF defaults.

In addition to accounting for these 178,000 locations, we anticipate that BEAD deployment projects are likely to experience cost overruns. To ensure that Eligible Entities have the means to address these overruns, we suggest setting aside additional funding, perhaps 20% or $4.3 billion of remaining BEAD funds, to account for unforeseen events that might occur over the next four to five years. A set aside of this size does not mean that funds will be wasted, because if the cost overruns do not materialize at this level, funds could be re-purposed for other uses or returned to the Treasury at the end of the fifth year of the BEAD program.

Adding in the additional $4.3 billion for cost overruns means that the rainy-day fund should be between $5.7-$6.0 billion, or 27% to 28.5% of the remaining BEAD funds. It, therefore, would be prudent for NTIA and Eligible Entities to set aside approximately $6 billion for a rainy-day fund focused on last-mile connectivity projects in unserved areas.

“It would be prudent for NTIA and Eligible Entities to set aside approximately $6 billion for a rainy-day fund for last-mile connectivity projects in unserved areas.”

The table below summarizes the elements of a BEAD rainy-day fund focused on bolstering last-mile connectivity projects in unserved communities.

A summary of variables used to calculate the potential size of a rainy-day fund.

In short, NTIA could adopt a requirement for Eligible Entities to reserve a portion of their remaining BEAD funds to bolster their last mile connectivity programs with percentages varying based on the presence of RDOF defaults. NTIA could then allow allocated funding in excess of these amounts—approximately $15 billion—to be spent on other NTIA-approved and statutorily-permitted uses. This is a prudent approach that will greatly increase the likelihood that last-mile infrastructure projects will be successfully completed and sustained.

In our next blog, we will look at statutory and other uses for the funds that could be used to facilitate the goals of the BEAD program, including how to further enhance streamlining of permitting processes at the state and local level, as well as promoting broadband adoption to ensure these networks have as broad a pool of potential subscribers as possible to help improve the profitability of operating broadband networks.